TechAnalysis for majors

-

EUR/USD has retained the 1.1850 key level. It triggered a correctional movement. I expect the further fall of the quotes and will sell the pair after it fixes below the 1.1770 local support. It may move to the 61,8%-78,6% correctional zone.

-

I expect a correction on AUD/USD. It has held the 0.7570-0.7580 demand zone. The price is testing the 0.7600 round level now. I’ll sell the pair, if it fixes above this mark. It may move to 0.7630-0.7645.

-

Bulls dominate the EUR/USD pair. The 1.1800 round level is the nearest resistance level. I plan to open deals in the current trend direction. I’ll buy the pair, if it fixes above 1.1800. The goal for taking profit is the 1.1840 local support. Entry points into the market may appear within a few days.

-

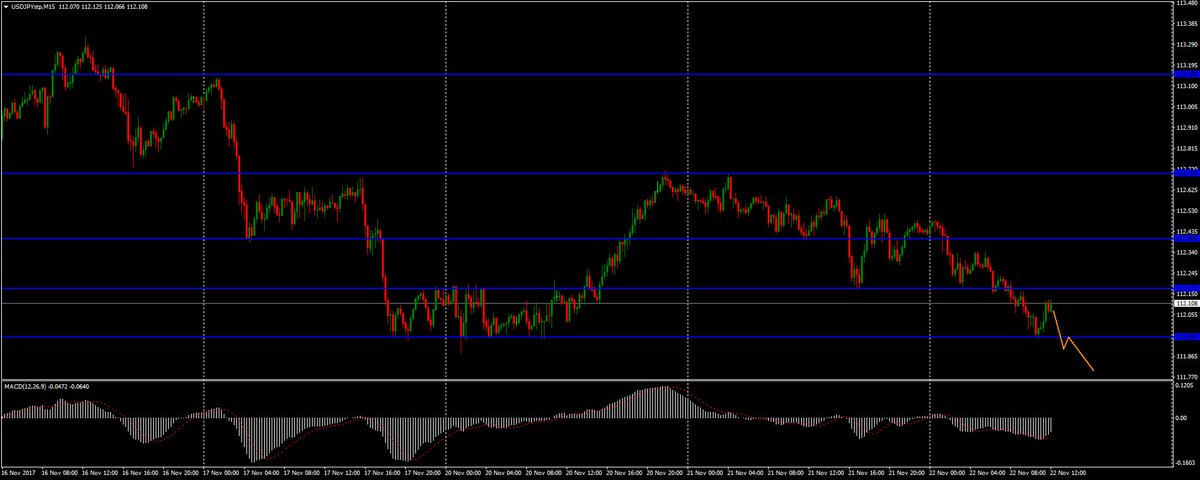

Bears dominate the USD/JPY pair for a long time already. The daily chart shows us that there may be a further fall in future. I plan to wait for a correction to 112.45-112.70. I’ll sell the pair, if it reaches this zone. The goal for taking profit is 112.00.

-

maybe but not sure

-

There is an interesting technical pattern on AUD/USD. It has retained the 0.7530-0.7540 local demand zone. AUD/USD has the potential for a correction. The confirming signal is the Bullish engulfing PA pattern. I’ll buy the pair, if it fixes above the 0.7570 resistance level. The goal for taking profit is 0.7600.

-

GBP/USD retained the 1.3260-1.3275 offer zone today. It triggered a bearish sentiment. I don’t exclude the further fall of the quotes and will sell the pair if it fixes under the 1.3220 mirror support level. It may move to 1.3180.

-

Originally posted by Samlee1122345:

maybe but not sure

What pair did you mean?

I agee, my analysis is not a guarantee of a successful deal, but I try to use technical analysis and price action patterns to forecast the price movements. -

Bears prevail on the USD/JPY pair. It has reached 112.00. I’ll open deals in the current trend direction and sell the pair, if it fixes below 111.95. It may move to 111.50.

-

An interesting technical pattern is on EUR/USD now. The price has retained the 1.1770 resistance level. It triggered a bearish sentiment, so I don’t rule out the further fall of the EUR/USD quotes. I’ll sell the pair, if it fixes below the 1.1750 mirror support level. It may move to 1.1725-1.1715.

-

The FOMC protocols indicated that officials are concerned about a low inflation level in the country. The US dollar has significantly weakened.

My yesterday's forecasts for USD/JPY were confirmed. The yen rose against the US dollar by more than 125 points. The quotes are consolidating in the 111.10-111.35 range of. I don’t exclude a technical correction in the near future. I plan to open positions from key levels.

I’ll buy the pair, if it fixes above the 111.35 resistance level. It may move to 111.60.

I’ll sell, if USD/JPY fixes below 111.10. It may move to 110.75-110.50.

-

Bulls prevail on AUD/USD, I don’t rule out the further growth of this pair, so I’ll open deals in the current trend direction. I’ll wait for the retest of the 0.7620 mirror support level and will buy the pair when it reaches this mark. It may move to 0.7650.

-

I think that the activity will be low today due to the US holidays.

The bullish sentiment prevails on USD/CAD. The Canadian dollar is under pressure due to the report on retail sales. I don’t rule out the further quotes growth. I’ll buy USD/CAD, if it fixes above the 1.2735 local support. The pair may move to 1.2760-1.2775.

-

Buyers prevail on the EUR/USD pair. I expect the further growth in the medium term. The TA pattern called Inverse Head & Shoulders emerged on the daily chart. It indicates a bullish sentiment, so I’ll buy EUR/USD when it fixed above 1.1870. The nearest goal for taking profit is 1.1900.

-

The demand for the US dollar is at a high level now.

Since the beginning of the week, EUR/USD is in the flat. The technical pattern is ambiguous. I’ve identified the following key nd resistance levels: 1.1840 and 1.1875. I’ll open deals after the price fixes above/below these marks.

I’ll sell, if it fixes below the 1.1840 support level. Take profit – at 1.1810.

I’ll buy, if it fixes above 1.1875. It may move to 1.1925.

-

Bears dominate on the AUD/USD pair. It happens due to a weak report on the GDP of Australia. I’ll open deals in the current trend direction and wait until the pair moves to the 0.7600 round level. I’ll sell it after it reaches this mark. The nearest goal for taking profit is 0.7575. The pair may move to 0.7555-0.7550.

-

Bulls prevail on USD/JPY. I expect the further quotes growth. The Bullish engulfing PA pattern has appeared near the 112.65 resistance pattern. I’ll buy the pair if it fixes above 112.65. The nearest goal for taking profit is 113.00.

-

A downward trend has been on EUR/USD since the beginning of the week. The demand for the US dollar remains at a high level. I’ll open deals in the current trend direction and will sell the pair with a trailing stop, if it fixes below the 1.1780 local support level. It may move to 1.1750-1.1720.

-

The report on the US labor market is at the center of attention today. Experts expect that in November the number of people employed in the non-agricultural sector of the country will slow down. The preliminary report from ADP exceeded the market expectations. At the same time, the index of business activity in the US non-manufacturing sector from ISM fell by 4.5% to 57.4. I expect high volatility, so I won’t trade today. Anyway, I defined the following key levels:

EUR/USD

support: 1.1720, 1.1650

resistance: 1.1760, 1.1800

-

USD/JPY

support: 113.25, 113.00, 112.40

resistance: 113.60, 114.00

-

There is a correction on EUR/USD after a significant fall that took place the last week. The price is testing the 1.1800 round level. I expect the further recoup of the quotes. The growth of the MACD histogram can be a confirming signal. I’ll buy EUR/USD, if it fixes above 1.1800. It may move to the 1.1840 mirror resistance level.

-

I expect the fall of the GBP/USD quotes. The Outside bar PA pattern has formed on the asset, it indicates a bearish sentiment. I’ll sell the pair, if it fixes below the 1.3340 support level. It may move to 1.3250.

-

The current technical pattern indicates a correction of the USD/CAD pair after a strong growth that took place the last week. The asset has retained the 1.2865 resistance level. It triggered the emergence of a bearish sentiment. The price is testing the 1.2820 local support now. I’ll sell USD/CAD, if it fixes below this mark. It may move to 1.2775.

-

A bullish sentiment prevails on NZD/USD. I expect the further growth. The pair has a good potential for the recoup. The Triple bottom TA pattern has appeared on the D1 chart. I’ll buy NZD/USD, if it fixes above the 0.6950 key resistance. It may move to 0.7000.

-

A weak report on the GB labor market was published today. GBP/USD has the potential for declining. I expect a bearish sentiment. I’ll sell the pair, if it fixes below the 1.3335 local support. The goal for taking profit is 1.3300.